The thrill of buying a new car is exhilarating, but it’s only the beginning of a long-term commitment to protecting your investment. As a Georgia driver, you’re well aware of the unpredictable roads and unpredictable drivers that come with them. From fender benders on I-85 to parking lot mishaps in Atlanta, the risks to your vehicle are ever-present. Without the right insurance coverage, a single accident can turn your dream ride into a financial nightmare. That’s where comprehensive and collision coverage come in – the dynamic duo of auto insurance that can save you from costly repairs and financial strain. In this post, we’ll delve into the importance of these essential coverage options, exploring the types of risks they protect against, the benefits of carrying them, and why they’re a must-have for Georgia drivers who want to drive away with peace of mind.

1. Introduction to Georgia’s driving landscape

The Peach State – where the sun shines bright, the peaches are sweet, and the roads are filled with adventure. But, let’s face it, Georgia’s driving landscape can be a daunting one. With Atlanta’s notorious traffic, rural roads that wind through scenic hills, and a growing population of drivers, the risk of accidents and vehicle damage is ever-present. From the bustling streets of Savannah to the mountainous roads of North Georgia, the state’s diverse terrain and driving conditions pose unique challenges to motorists. In fact, Georgia consistently ranks among the top 10 states for traffic fatalities, with distracted driving, reckless behavior, and inclement weather contributing to a significant number of accidents each year. Add to that the threat of vandalism, theft, and natural disasters, and it’s clear that Georgia drivers need protection that goes beyond the minimum requirements. That’s where comprehensive and collision coverage come in – essential components of a robust auto insurance policy that can help you navigate the unpredictable roads of Georgia with confidence.

2. What is comprehensive coverage and why do you need it?

Comprehensive coverage is often misunderstood as an optional add-on to your auto insurance policy, but it’s a crucial component that can save you from financial disaster. In simple terms, comprehensive coverage protects your vehicle from damages that aren’t related to a collision with another car or object. This means that if your vehicle is damaged or lost due to circumstances beyond your control, such as natural disasters, vandalism, theft, or even a run-in with a rogue deer, comprehensive coverage has got you covered. Imagine waking up one morning to find that a severe hail storm has left your brand-new vehicle looking like a golf ball, or returning to your parking spot to discover that your car has been broken into and valuables stolen. Without comprehensive coverage, you’d be left to foot the bill for repairs or replacement, which could be a significant financial burden. In Georgia, where severe weather events and high crime rates are a reality, comprehensive coverage is not just a nice-to-have, but a must-have. By investing in comprehensive coverage, you can drive with confidence, knowing that you’re protected against the unexpected.

3. What is collision coverage and how does it differ from comprehensive?

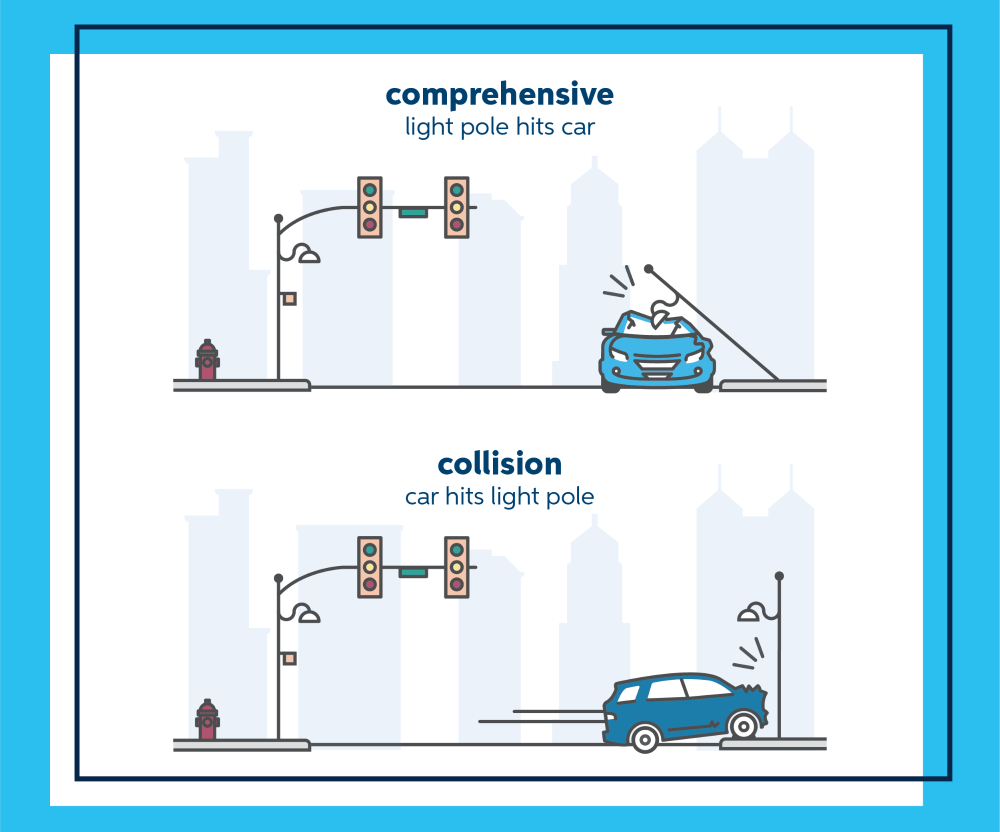

When it comes to protecting your new vehicle, understanding the nuances of auto insurance can be overwhelming. Two crucial components of a robust insurance policy are comprehensive and collision coverage. While they’re often mentioned together, they serve distinct purposes and offer different types of protection. Collision coverage is specifically designed to cover damages to your vehicle resulting from a collision with another vehicle or object, such as a fence, pole, or even a tree. This type of coverage kicks in regardless of who is at fault in the accident. For example, if you’re involved in a fender bender on I-85, collision coverage will help pay for the repairs to your vehicle, minus your deductible. Without collision coverage, you’d be responsible for paying out-of-pocket for these repairs, which can be a significant financial burden. In contrast, comprehensive coverage takes care of damages to your vehicle that aren’t related to a collision. This includes things like theft, vandalism, fire, hail, and even animal collisions. If a stray deer suddenly darts onto the road, causing damage to your vehicle, comprehensive coverage would help cover the costs of repairs. In Georgia, where the roads can be unforgiving and unpredictable, having both comprehensive and collision coverage is essential for protecting your investment. By understanding the differences between these two types of coverage, you can make informed decisions about your insurance policy and ensure you’re adequately prepared for the unexpected.

4. The risks of driving in Georgia: accident statistics and road hazards

Georgia’s roads can be a treacherous terrain, especially for new drivers. With a growing population and a thriving economy, the state’s highways are becoming increasingly congested, leading to a higher risk of accidents. According to the Georgia Department of Transportation, there were over 385,000 crashes on the state’s roads in 2020 alone, resulting in over 1,500 fatalities and more than 130,000 injuries. These statistics are sobering, and they underscore the importance of having comprehensive and collision coverage to protect your new vehicle. But it’s not just other drivers that pose a risk. Georgia’s roads are also prone to hazards such as potholes, construction zones, and inclement weather, which can cause damage to your vehicle even if you’re the most careful driver. For example, a sudden rainstorm can cause hydroplaning, or a pothole can leave your vehicle with a nasty dent or a blown tire. Without comprehensive and collision coverage, you could be left footing the bill for costly repairs or even worse, be forced to replace your vehicle altogether. In addition, Georgia’s urban areas, such as Atlanta, are notorious for their aggressive drivers, pedestrians, and cyclists, which can increase the risk of accidents. Moreover, the state’s rural areas can be just as hazardous, with winding roads and limited visibility increasing the risk of accidents. In either case, having comprehensive and collision coverage can provide you with financial protection and peace of mind, ensuring that you’re prepared for any situation that may arise on Georgia’s roads.

5. What’s at stake: the financial costs of an accident

The financial burden of an accident can be devastating, and for Georgia drivers, the stakes are especially high. Without comprehensive and collision coverage, a single accident can leave you with a mountain of expenses, from repair costs to medical bills, that can quickly drain your bank account. Imagine being involved in a fender bender, only to discover that the other driver is uninsured or underinsured, leaving you to foot the bill for repairs and medical expenses. Or, picture this: a severe storm rolls in, and a fallen tree branch shatters your windshield, leaving you with a hefty repair bill. Without comprehensive coverage, you’ll be forced to pay out of pocket for the damages, which can be a significant financial strain. And if you’re involved in a collision, the costs can be even more crippling. In Georgia, the average cost of a car accident is around $10,000, and that’s not even including the potential for long-term medical expenses or lost wages. By investing in comprehensive and collision coverage, you can protect yourself from these financial risks and ensure that you’re not left reeling from the unexpected costs of an accident.

6. How comprehensive and collision coverage can save you money

The thrill of driving off the lot in your brand new vehicle is a feeling like no other. But, before you even have a chance to break in those new car seats, the harsh realities of Georgia’s roads can quickly bring you back down to earth. From unpredictable weather conditions to reckless drivers, the risks of damage to your vehicle are ever-present. That’s why comprehensive and collision coverage are essential for Georgia drivers. Without these critical components of your auto insurance policy, you could be left footing the bill for costly repairs or even worse, forced to write off your vehicle entirely. The financial burden of such an event can be crippling, especially for those who rely on their vehicle for daily transportation. But, with comprehensive and collision coverage, you can rest assured that you’re protected against the unexpected. In the event of a collision, this coverage will help cover the costs of repairs or replacement, regardless of who’s at fault. And, with comprehensive coverage, you’re protected against damage caused by natural disasters, theft, vandalism, and other non-collision events. By investing in these types of coverage, you can avoid the financial pitfalls of unexpected repairs and ensure that you’re back on the road in no time. In the long run, comprehensive and collision coverage can save you money, reduce stress, and provide peace of mind – a priceless commodity for any driver.

7. Common myths about comprehensive and collision coverage debunked

When it comes to protecting your new vehicle, myths and misconceptions can lead to costly mistakes. Many Georgia drivers may think they’re saving money by skipping comprehensive and collision coverage, but in reality, they’re putting themselves at risk of financial devastation. Let’s set the record straight by debunking some common myths surrounding these essential coverage options. Myth: Comprehensive coverage is only for natural disasters like hurricanes and floods. Reality: Comprehensive coverage extends far beyond natural disasters, covering damage from vandalism, theft, animal collisions, and even falling objects like tree branches. Myth: Collision coverage is only necessary for high-risk drivers. Reality: Accidents can happen to anyone, regardless of their driving record. Without collision coverage, you’ll be on the hook for costly repairs or even the full value of your vehicle. Myth: Comprehensive and collision coverage are too expensive. Reality: While these coverage options may add to your premium, the cost of repairing or replacing your vehicle without them can be financially crippling. By separating fact from fiction, you can make informed decisions about protecting your new ride. Don’t let myths and misconceptions leave you vulnerable to financial loss – invest in comprehensive and collision coverage for peace of mind on Georgia’s roads.

8. Understanding policy limits and deductibles

When it comes to protecting your new ride, understanding the intricacies of your insurance policy is crucial. Two of the most critical components to grasp are policy limits and deductibles. Think of policy limits as the maximum amount your insurance company will pay out in the event of a claim. For example, if you have a policy limit of $50,000 for collision coverage and you’re involved in an accident that results in $75,000 worth of damage, you’ll be left to cover the remaining $25,000 out of pocket. Ouch! That’s why it’s essential to choose a policy limit that accurately reflects the value of your vehicle. Deductibles, on the other hand, are the amount you’ll need to pay upfront when filing a claim. Let’s say you have a $500 deductible for comprehensive coverage and your car’s windshield is shattered by a stray rock on the highway. You’ll need to pay the first $500 towards the repair, and your insurance company will cover the remaining cost. The key is to strike a balance between policy limits and deductibles that works for your budget and provides adequate protection for your vehicle. By doing so, you’ll be able to drive away with confidence, knowing that you’re prepared for any unexpected events that may come your way.

9. How to choose the right coverage for your vehicle

Choosing the right coverage for your vehicle can be a daunting task, especially with the numerous options available in the market. However, it’s essential to get it right to ensure your new ride is protected from unforeseen circumstances. To make an informed decision, consider the following factors: the value of your vehicle, your driving habits, and your personal financial situation. If you’re driving a brand-new car, it’s highly recommended to opt for comprehensive and collision coverage. These types of coverage will provide you with financial protection in the event of an accident, theft, vandalism, or natural disasters. On the other hand, if you’re driving an older vehicle, you may want to consider liability coverage only, as the cost of repairs or replacement might not be worth the premium. Additionally, take into account your driving habits. If you have a long commute, drive frequently in heavy traffic, or have a history of accidents, you may want to consider higher coverage limits. On the other hand, if you’re a low-mileage driver, you may be able to get away with lower coverage limits. Lastly, consider your personal financial situation. If you have a tight budget, you may want to opt for a higher deductible to lower your premium. However, if you have a financial cushion, you may want to opt for a lower deductible to ensure you’re not out of pocket in the event of an accident. By carefully considering these factors, you can choose the right coverage for your vehicle and ensure you’re protected in the event of an unexpected event.

10. Real-life scenarios: when comprehensive and collision coverage come into play

As a Georgia driver, you never know when disaster might strike. But with comprehensive and collision coverage, you can rest assured that you’re prepared for the unexpected. Let’s take a look at some real-life scenarios where these types of coverage can make all the difference. Imagine you’re driving home from a Braves game on a rainy night, and a strong gust of wind blows a tree branch onto your brand-new car. Without comprehensive coverage, you’d be left to foot the bill for the repairs. But with this type of coverage, you can file a claim and get your car fixed quickly and easily. Or, picture this: you’re running errands on a busy Saturday morning, and another driver runs a red light, slamming into your vehicle. Collision coverage would kick in to cover the damages, even if the other driver doesn’t have insurance. What if you wake up one morning to find that your car has been vandalized, with scratches and dents covering the entire side panel? Comprehensive coverage would help you cover the cost of repairs, so you can get your car looking like new again. These scenarios may seem unlikely, but they can happen to anyone, at any time. And without the right coverage, you could be left with a hefty repair bill. By investing in comprehensive and collision coverage, you can drive with confidence, knowing that you’re protected from the unexpected twists and turns of life on the road.

11. Georgia’s insurance requirements: what you need to know

As a Georgia driver, it’s essential to understand the state’s insurance requirements to ensure you’re adequately protected on the road. While liability insurance is the minimum coverage required by law, it’s crucial to recognize that this coverage only extends to damages or injuries you cause to others in an accident. In other words, liability insurance won’t cover repairs to your own vehicle or medical expenses if you’re involved in a collision. Georgia’s minimum insurance requirements include: * Bodily injury liability: $25,000 per person and $50,000 per accident * Property damage liability: $25,000 per accident While these requirements provide a safety net for other drivers and pedestrians, they leave you and your vehicle vulnerable in the event of an accident. That’s why comprehensive and collision coverage are a must for Georgia drivers. These types of coverage can help protect your vehicle and financial well-being in the event of a collision, theft, vandalism, or other unforeseen events. By investing in comprehensive and collision coverage, you can enjoy greater peace of mind on the road, knowing that you’re prepared for the unexpected.

12. Tips for getting the best insurance rates in Georgia

As a Georgia driver, you’re likely no stranger to the unpredictable roads and unpredictable weather that can come with living in the Peach State. But while you can’t control the actions of other drivers or the whims of Mother Nature, you can take control of your insurance premiums by shopping smart and driving safely. Here are some valuable tips for getting the best insurance rates in Georgia: First, maintain a clean driving record. Insurance companies reward safe drivers with lower premiums, so avoid accidents and tickets to keep your rates low. Next, consider raising your deductible – this can help lower your premiums, but be sure you have enough savings set aside to cover the increased out-of-pocket cost in the event of a claim. Additionally, take advantage of discounts for things like being a good student, being a member of certain professional organizations, or having certain safety features installed in your vehicle. And, of course, shop around! Compare rates from different insurance companies to find the best deal for your needs and budget. Finally, consider bundling your policies – many insurance companies offer discounts for customers who purchase multiple types of insurance (such as home and auto) from the same provider. By following these simple tips, you can enjoy the peace of mind that comes with comprehensive and collision coverage while also keeping your hard-earned cash in your wallet. As you drive off the lot in your new vehicle, the last thing on your mind is likely to be a fender bender or a tree branch falling on your hood. But, as a Georgia driver, you know that unexpected events can happen in the blink of an eye. That’s why it’s crucial to protect your new ride with comprehensive and collision coverage. By investing in these essential insurance policies, you’ll be safeguarding your financial well-being and ensuring that your vehicle is repaired or replaced if disaster strikes. Don’t let the open road leave you vulnerable – make sure you’re adequately covered and enjoy the freedom to drive with confidence.